Departamento de Relaciones Económicas Internacionales

Artículos

Deindustrialization in Europe – Time for a new Economic Model?

Thomas Obst [1]

Since the outbreak of the Corona pandemic in 2020, when the world faced a historic health crisis, countries have faced several challenges. First, the pandemic caused supply-sided shocks hindering production: lack of materials, disrupted supply chains, workers refrained from going to work, restricted social mobility etc. It also caused structural changes in demand such as shifts from services to durable goods. Households refrained from consumption and instead accumulated excess savings.

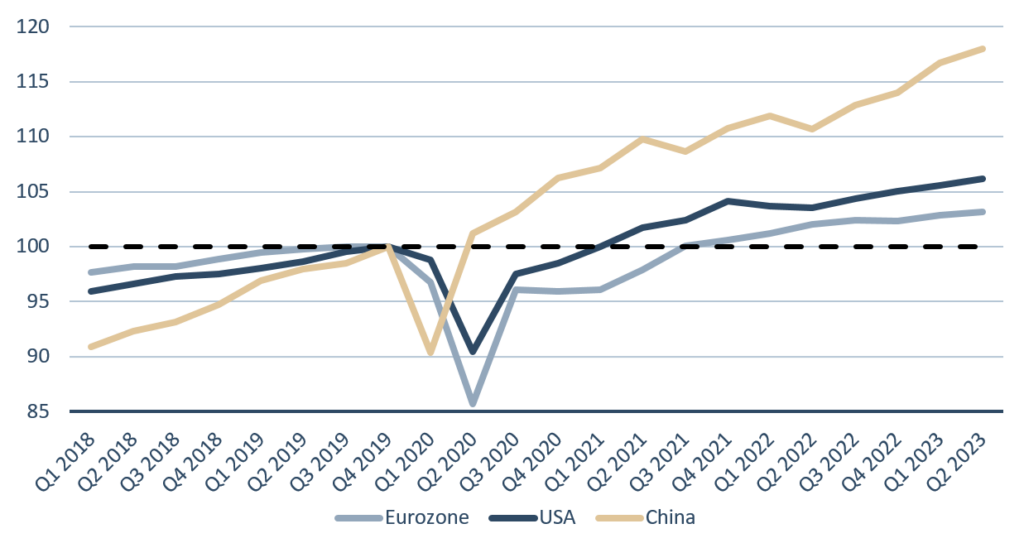

Figure 1 shows the development of real GDP since Q42019 before the pandemic hit which we define as the ‘pre-crisis-level’ until Q2 2023 for the three largest economies of the world. We can see the severe economic slump in Q2 2022 when production was halted, and borders closed. Economic output fell by up to 15 percent in the Eurozone and roughly 10 percent in China and the US. However, after reopening the economy the rebound was strong. Many economists wondered whether the recovery is going to be V-shaped.

Policymakers reacted swiftly and initiated historic stimulus packages to keep the economy afloat. In particular, the US spent almost 25 percent of their GDP to help businesses and households during the crisis (Kunath et al., 2022). This was accommodated by a very loose monetary policy. The ECB initiated for instance two programs: Pandemic Emergency Purchase Programme (PEPP) and the Asset Purchase Programme (APP) which alone comprised more than EUR 5 trillion, doubling the balance sheet of the ECB between beginning of 2020 and end of 2021.

However, a V-shaped recovery only occurred in China where GDP exceeded its pre-crisis level already in Q2 2020, followed by the US in Q1 20201. GDP recovered more slowly in the Eurozone where the pre-crisis level was only reached in Q3 2021. Since autumn 2021 economic optimism came back based on the rebound in private consumption and an ease of restrictions in global supply chains leading to strong growth rates in the Eurozone and the US. In China, the draconian lockdowns as part of a failed zero covid policy led to a more volatile development.

Figure 1: Eurozone is lagging behind China and US

Real GDP growth, quarterly, seasonally adjusted, Q42019 = 100

Source: Eurostat; OECD; World Bank

Since the outbreak of the war of aggression by Russia on Ukraine in February 2022 we can see a divergence between the US and the Eurozone. GDP is more than 6 percent above the pre-crisis-level in the US it remains standing only 3 percent above it in the Eurozone. In the largest economy of Europe, Germany, GDP is still hovering around the pre-crisis-level. The IMF forecasts a mild recession of -0.3 percent GDP growth in 2023 which makes Germany the worst performing economy this year and has called into question whether it’s becoming the ‘sick man of Europe’ again. Overall, the pandemic has revealed and amplified structural issues in recent years.

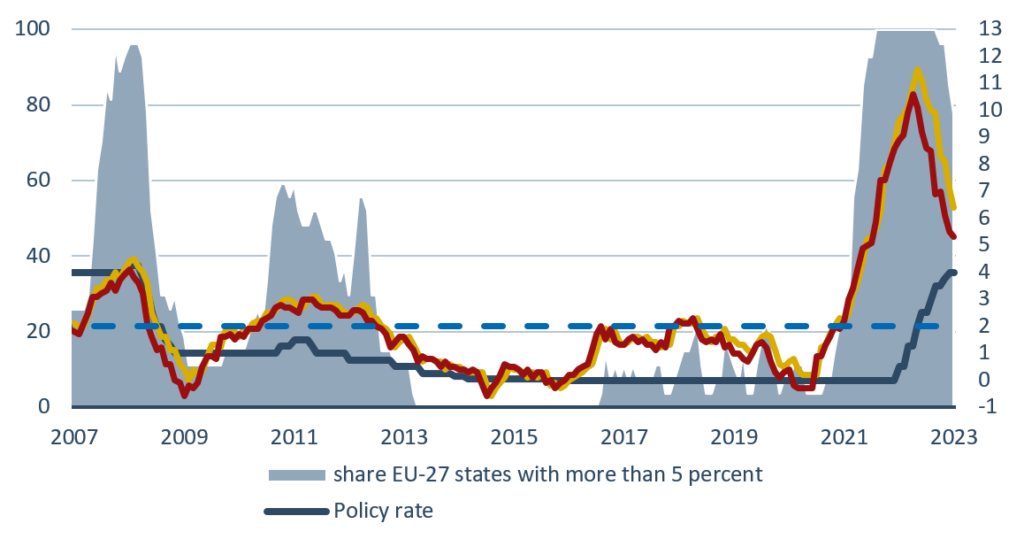

Second, the outbreak of the war in Ukraine has led to historic inflation rates in Europe. Figure 2 shows the historic dimension of the recent price increases. In the Eurozone as well as in the EU-27 inflation rates increased from their low figures in winter 2020 to their peak of almost 12 percent in the EU-27 in winter 2022. At this point 100 percent of the EU-27 countries had inflation rates higher than 5 percent, a situation last seen before the financial crisis in 2008. Since summer 2021 inflation rose due to disrupted supply chains, higher container freight rates and elevated energy prices. Together with a rebound in demand after lockdowns had been lifted these factors caused an increase in relative prices which many economists in summer 2021 thus regarded to be temporary (Lane, 2022). Hence, the ECB’s reaction only in summer of 2022 started a rate hiking cycle that brought the policy rate up to 4 percent in July 2023.

Figure 2: Energy price shocks caused historic inflation rates

EU-27 countries share in percent (left), inflation rates (right)

Source: Eurostat, ECB.

The energy price shocks were unprecedented. In addition, a weak Euro and deteriorating terms of trade amplified imported inflation in 2022. In Germany, not only did import prices reach historic levels but producer prices exceeded the historic episodes of the 1970s where two oil crises hit the European economy. Producer prices reached unprecedented levels of 46 percent in autumn 2022. However, the Eurozone is now entering a second phase of inflation where the exogenous price shocks are fading and domestic developments in labor and goods market are driving inflations. These represent second round effects and are begging the question whether a wage-price-spiral might occur (Arce et al., 2023). Stagflation is thus a veritable risk in Europe (Demary and Hüther, 2022).

Finally, we want to draw out attention to one of the probably most discussed and contested economic issues facing Europe and in particular its largest economy Germany – the danger of deindustrialization. In 2022, gas prices increased exponentially to 300 Euros per megawatt hour due to the uncertain outlook on gas supply from Russia to Europe (Küper and Obst, 2023). By the end of August 2022 Russian gas stopped flowing towards Germany which imported more than half of it from Russia before the war started in February 2022.

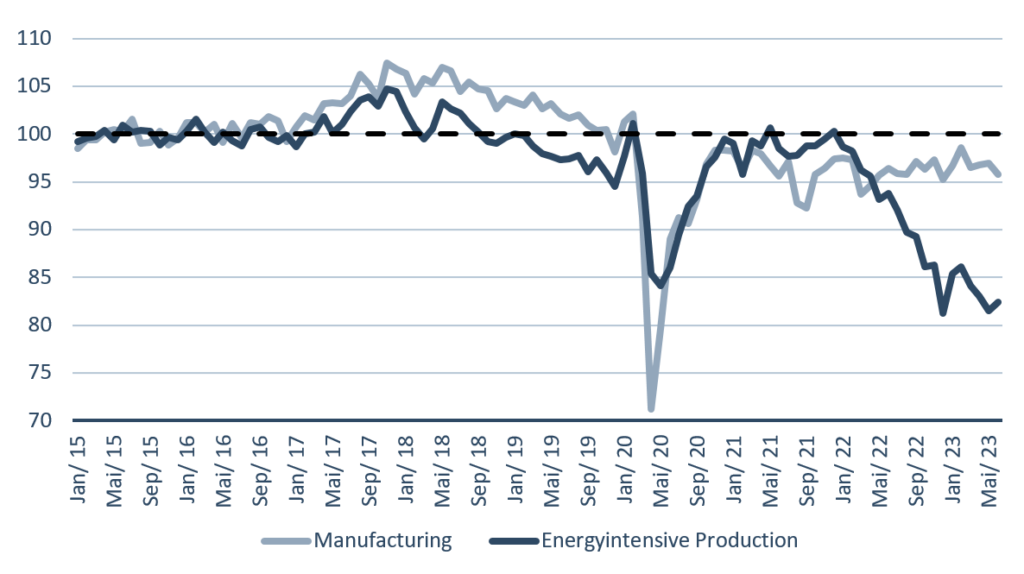

Figure 3 shows overall production in the manufacturing sector in Germany as well as the energy intensive production between 2015 and 2023. There are several developments standing out. First, after an initial phase of expansion in manufacturing until mid-2018 we can see that the industrial sector in Germany has been in decline ever since. This contrasts with other European countries like Austria or Poland where the industrial sector expanded. Moreover, it indicates that the industrial recession in Germany is not only due to the pandemic or the war in Ukraine but also due to structural issues it has been facing. Second, during the Q2 2020 manufacturing plummeted by almost 30 percent and has not fully recovered. Third, since the outbreak of the war in Ukraine we see a clear divergence between manufacturing and energy intensive production. Production in the energy intensive sectors such as chemicals, metals or paper declined even more than during the pandemic remaining roughly 20 percent below February last year.

Figure 3: Energy intensive production decouples from manufacturing in Germany

Industrial production, Index 01/2015 = 100, until 05/2023

Source: German statistical office.

The German manufacturing sector is the largest in Europe. It comprises more than 20 percent of value added and employs more than 5 million people in Germany. Total output exceeded 1 trillion Euro in 2022. Energy intensive production constitutes only 3 per cent of total output but 15 percent of value added in manufacturing. In addition, the German industrial hub is highly intertwined with European supply chains. The German economy is thus particularly vulnerable to the recent shocks in energy but also to increasing geopolitical tensions between the US and China. Another indication that Germany faces deindustrialization is the historic net outflows of direct investments. In 2022, a record sum of 132 billion US-Dollar left the country (Rusche, 2023). The sharp rise in investment capital outflows from Germany is a warning signal that the private sector is losing its appeal to foreign investors.

Europe’s dependence on energy imports from Russia has thus become a crucial issue for the economic prospects in this decade. While the question of deindustrialization received a lot of attention with predicted adverse effects on output in the short run, it remains an open question whether Europe will experience a medium to long-term erosion of industrial competitiveness.

Time for a new economic model – a revival in industrial policy?

In the US, the Inflation Reduction Act (IRA) embodies the idea of modern supply side economics, in which economic growth is to be stimulated by increasing both labor supply and productivity while reducing inequality and environmental damage. In the short term Bidenomics – the economic policy of the incumbent president that has become a buzzword for Joe Biden’s billion-dollar supply side policy creating new private investments in broadband networks, semiconductors, electric vehicles and batteries – seems to achieve a renaissance of U.S. manufacturing. Europe, battered by the energy crisis, reacted quickly by proclaiming its own industrial program as part of the pre-existing Green Deal. Europe already subsidizes climate-friendly technologies on a large scale, for example through the NextGenEU reconstruction 800 billion Euro program.

A changing geopolitical landscape, the experience of failing global supply chains and most recently the energy crisis has led to a renewed interest in industrial policy (Aghion et al., 2023). At the core, considerations about new industrial policy brings back old questions such as how big government intervention must be, how to create policies that strengthen economic growth without hurting competition and whether it is possible to strategically create or keep industries through subsidies. A new industrial policy must also answer the question how to strengthen the industrial base without hindering necessary structural change in times of decarbonization. The question becomes what a new industrial policy should achieve.

First, industrial policy could be employed to reach strategic autonomy. The systemic conflict with China may require value chains to be protected against political risks that do not appear to be worthwhile in microeconomic terms on a company level. The EU has integrated export restrictions and investment screening back in the toolbox of industrial policy. Second, an active Industrial policy can help to shape energy transformation and creates economic growth. This requires substantial public investments in infrastructure and the educational sector. On the contrary, a passive strategy based on de-growth would simply reduce domestic emissions while production shifts abroad. Figure 3 has shown that energy intensive production severely suffered through the energy price shocks. It indicates that companies could not just increase efficiency or substitute products but needed to stop production in Germany. Third, entering a subsidy race with the US and China would disturb international allocation of resources and does not pay attention to the comparative and absolute cost advantages of the respective countries. Fourth, increasing geopolitical conflict and system competition with China can turn strong economic dependencies in critical areas into blackmail opportunities. Also, the pandemic has led to a global shortage of semiconductors and revealed vulnerabilities in global supply chains. Hence, ‘Reshoring’ as a strategy can increase resilience in supply chains while it increases cost of production. Fifth, an industrial policy should aim to include competition for the best technologies instead pre-determining what are the right ones to reduce CO2 emissions. Examples are the one-sided focus on batteries in the automotive sector as well as on heating pumps in the building sector.

In conclusion, a future industrial policy must not become interventionist, protectionist and arbitrary, but must be guided by regulatory criteria that take into consideration issues of the real economy and derive targeted measures. A high or low industrial share of GDP is neither good nor bad in itself, but a temporally defined consequence of the international division of labor and specialization under the given market conditions as well as structural path dependencies. Whether it will succeed also depends on paying close attention to a country’s business model. Industrial policies like the IRA can lead to a revival in manufacturing. Indeed, it has already caused an investment boom in the sector. Nevertheless, it bears several risks. An industrial policy designed to produce ‘national champions’ has often failed in the past. It is also expensive using state money and has the potential to harm competitiveness in the longer term through higher taxes. In Europe, it might lead to new dependencies for critical raw materials needed in the energy transition.

Bibliographic references

Aghion, P., Ahuja, K., Bown, C.P., Cantner, U., Criscuolo, C., Dechezleprêtre, A., Dewatripont, M., Hausmann, R., Lalanne, G., McWilliams, B. and Rodrik, D., 2023. Sparking Europe’s new industrial revolution-A policy for net zero, growth and resilience. Bruegel.

Demary Markus / Hüther Michael, 2022, How Large Is the Risk of Stagflation in the Eurozone, in: Intereconomics, Volume 57 (1), pp. 34-39

Kunath, Gero / Matthes, Jürgen / Obst, Thomas, 2022, Biden’s economic agenda risks mid-term elections. An analysis of Biden’s economic agenda and its effects on the American econo-my, IW-Report, Nr. 59, Köln / Berlin

Küper, Malte / Obst, Thomas, 2023, Energieintensive Produktion bricht stärker als während der Pandemie ein, IW-Kurzbericht, Nr. 19, Köln / Berlin

Lane, Philip, 25.11.2022, Inflation Diagnostics, Frankfurt am Main, https://www.ecb.europa.eu/press/blog/date/2022/html/ecb.blog221125~d34babdf3e.en.html [17.07.2023]

Rusche, Christian, 2023, Deindustrialisierung. Eine Analyse auf Basis von Direktinvestitionen, IW-Kurzbericht, Nr. 43, Köln

[1] Senior Economist Topic Cluster Global & Regional Markets Institute of the German Economy Cologne e.V. Berlín.